1) Quick Summary 🗞️

Betting volume of $38.8m in Q3 vs. $24.9m in Q3 2023 (+56%)

Total bettors of 2,018 in Q3 vs. 676 in Q3 2023 (+199%)

Completed migration to SX Rollup & became largest betting app on Arbitrum

Dev focus in Q4: launch of the SX Casino, order book upgrade, & Cashout launch

Biz focus in Q4: cross-chain launches and liquidity integrations

2) Key Metrics 📊

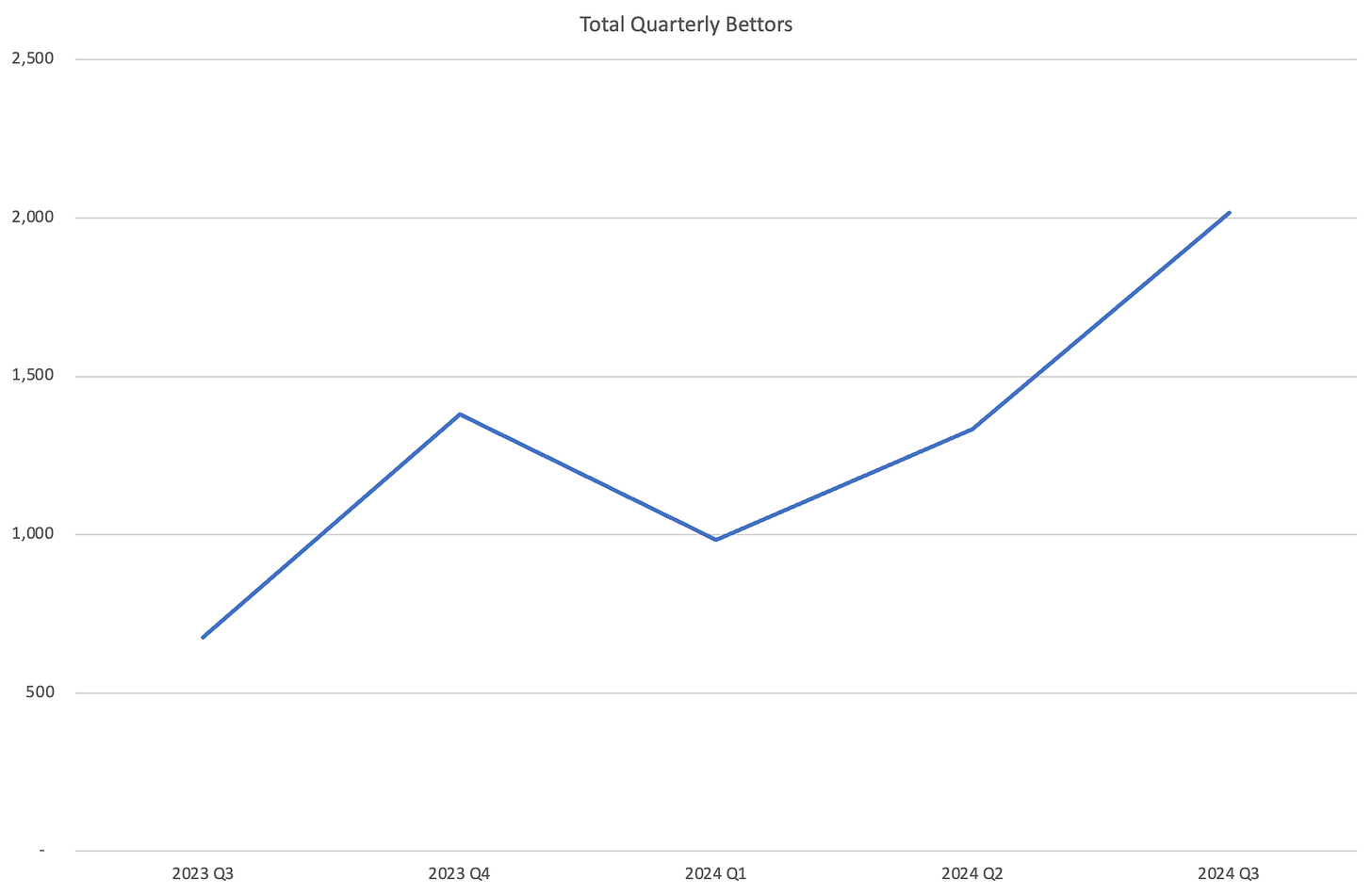

Number of Bettors

Number of quarterly bettors hit a new record high in Q3 at 2,018, which was a 199% increase from Q3 last year and a 51.5% increase from Q2. Arbitrum cross-chain rollout was a big reason for this increase; it’s much more economical for smaller crypto-native bettors to bet from a chain they already have funds on. Expecting this growth to accelerate as we rollout support for more low-cost L2 chains like Scroll and Mode.

Betting Volume

Sports betting volumes are highly seasonal, so it's best to compare quarters YoY to see underlying trends. The chart above shows SX's total betting volume in Q3 (July-September) from 2019 to 2024. As we can see, betting volume in Q3 hit a peak in 2022 (thanks to the World Cup), before declining to $24.9m last year, and increasing 56% YoY to $38.8m in Q3 of 2024. Betting volume momentum should continue into Q4; our most active quarter of the year for sports.

SX Bet Mining Incentives ($)

Increase in bet volume is contrasted by the consistently decreasing trend of SX bet mining incentives spent in Q3, shown in the chart above. Total bet mining incentives have now been entirely eliminated; this past quarter was the first full quarter with zero bet mining incentives since token launch in 2021. SX is now growing with no SX token incentives.

SX Token Vesting

Finally, SX token is now 90.72% vested. As a reminder, SX token launched in January 2021 with a 4-year monthly linear vesting contract for team members, backers, advisors, and the community fund. The final vesting date is now less than 4 months away. At that point, SX token will be 100% vested and no new supply will be unlocked.

3) Achievements ✅

SX had a busy summer on both the technical and business side:

🖥️ Technical

✔️ Launch of SX Rollup: SX Bet completed it’s migration to the SX Rollup in August. SX Rollup is a native Arbitrum Orbit L2 rollup. It offers a number of huge advantages for SX over its old Polygon Edge infrastructure: 8x faster block times, more secure bridging, and easier onboarding. The faster block times also enable SX to launch new features such as onchain order books, cross-chain live betting, and onchain casino games. SX Rollup is nearing $10m in total TVL.

🏎️ Live on MollyBet: SX was officially integrated into MollyBet, the world’s largest aggregator of sports betting liquidity in the entire world. Professional bettors use MollyBet as a smart-order routing system that enables them to tap into all the world’s top betting markets in one, easy-to-use interface. Most importantly, professional bettors get to access this liquidity directly through MollyBet. This integration has already driven solid amounts of taker flow to SX. SX’s industry-leading odds put it first-in line to access MollyBet’s taker flow, helping drive a virtuous cycle of activity and liquidity to SX.

📜 Cross-Chain Deployment on Scroll & Mode: SX pioneered cross-chain betting with the launch of SX Bet on Arbitrum in Q2. Furthermore, SX’s cross-chain liquidity hub and spoke model makes it extremely simple and capital efficient to launch on new chains. SX has begun experimenting with this model, deploying SX Bet on new L2s such as Scroll and Mode. SX has an opportunity to establish itself as the dominant betting app of every significant L1 and L2.

📈 Growth

⚾ Best MLB and NFL Odds in World: SX Bet has now has the best pregame MLB and NFL odds in the world as measured by vig. SX’s unique decentralized betting exchange, open APIs, and network of market-makers enable this. Based on a snapshot of odds on September 24th, (using OddsJam’s odds comparison tool), SX Bet has an average vig of 1.30% for all MLB games. This is in contrast to an average vig of 4.3% for traditional sportsbooks like DraftKings. We’re still onboarding more market-makers and believe we can get this vig to consistently <1% in the coming weeks. Headline odds matter for user awareness (as SX shows up on the top of odds comparison sites), acquisition (price-sensitive users and aggregators flow to where liquidity is best), and retention (other sites look like rip-offs once you’ve used SX).

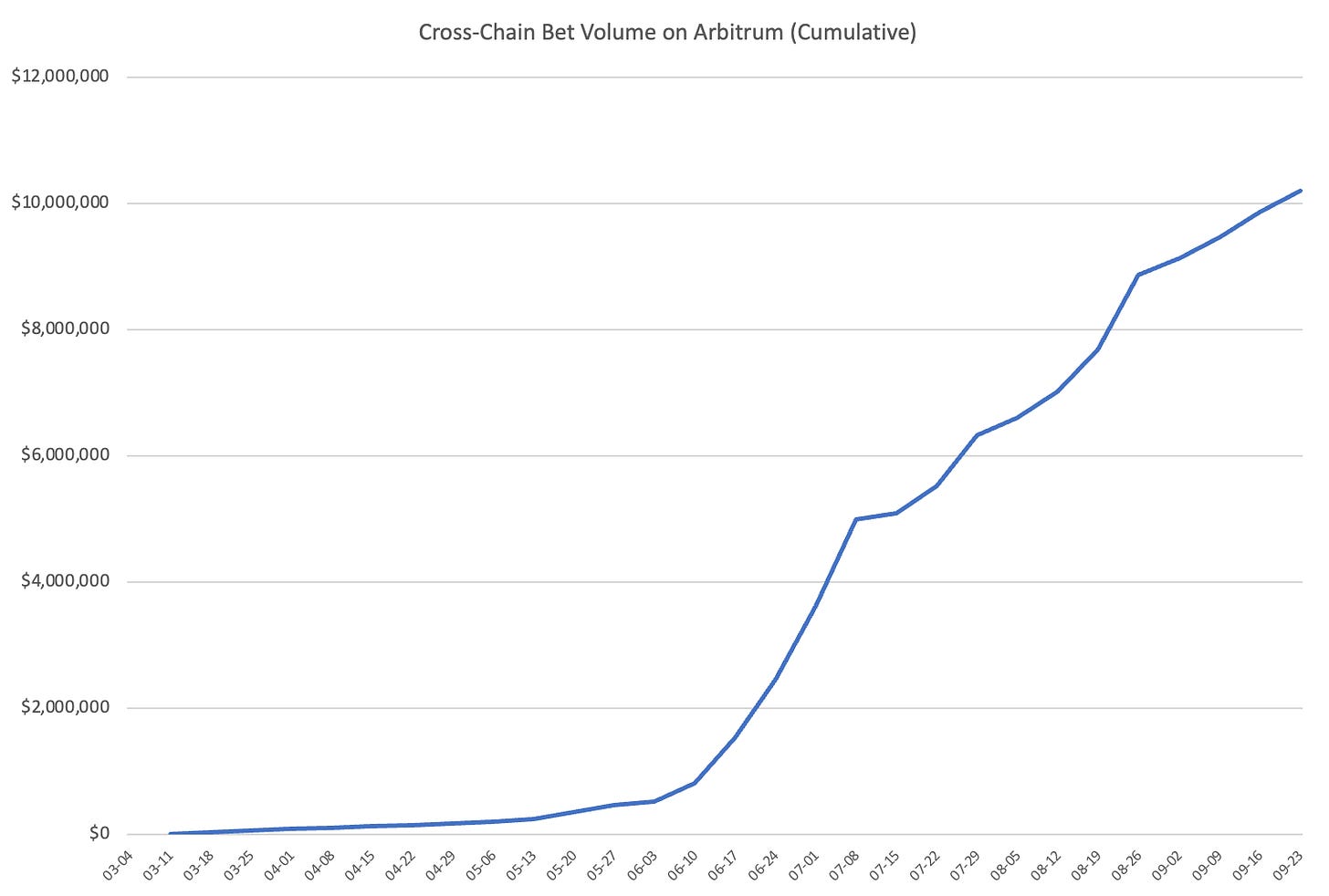

🏆 Largest Betting App on Arbitrum: SX Bet became the largest betting app on Arbitrum by betting volume in Q3. Arbitrum cross-chain betting volume continues to make up roughly ~20% of daily taker volume on SX (~$65,000 of bets per day post-incentives). Many crypto-native whales enjoy the relative convenience and security of betting from Arbitrum. This implies that launching on other, whale-heavy chains such as Ethereum, Polygon, and Solana would contribute meaningfully to daily betting volume. Cross-chain bettors tend to be less price sensitive than SX Rollup bettors, opening up the opportunity for meaningful protocol revenue through the implementation of a cross-chain commission. For context, a 3% commission on cross-chain bet winnings would yield roughly $30k/month in protocol revenue from current Arbitrum daily betting volume alone.

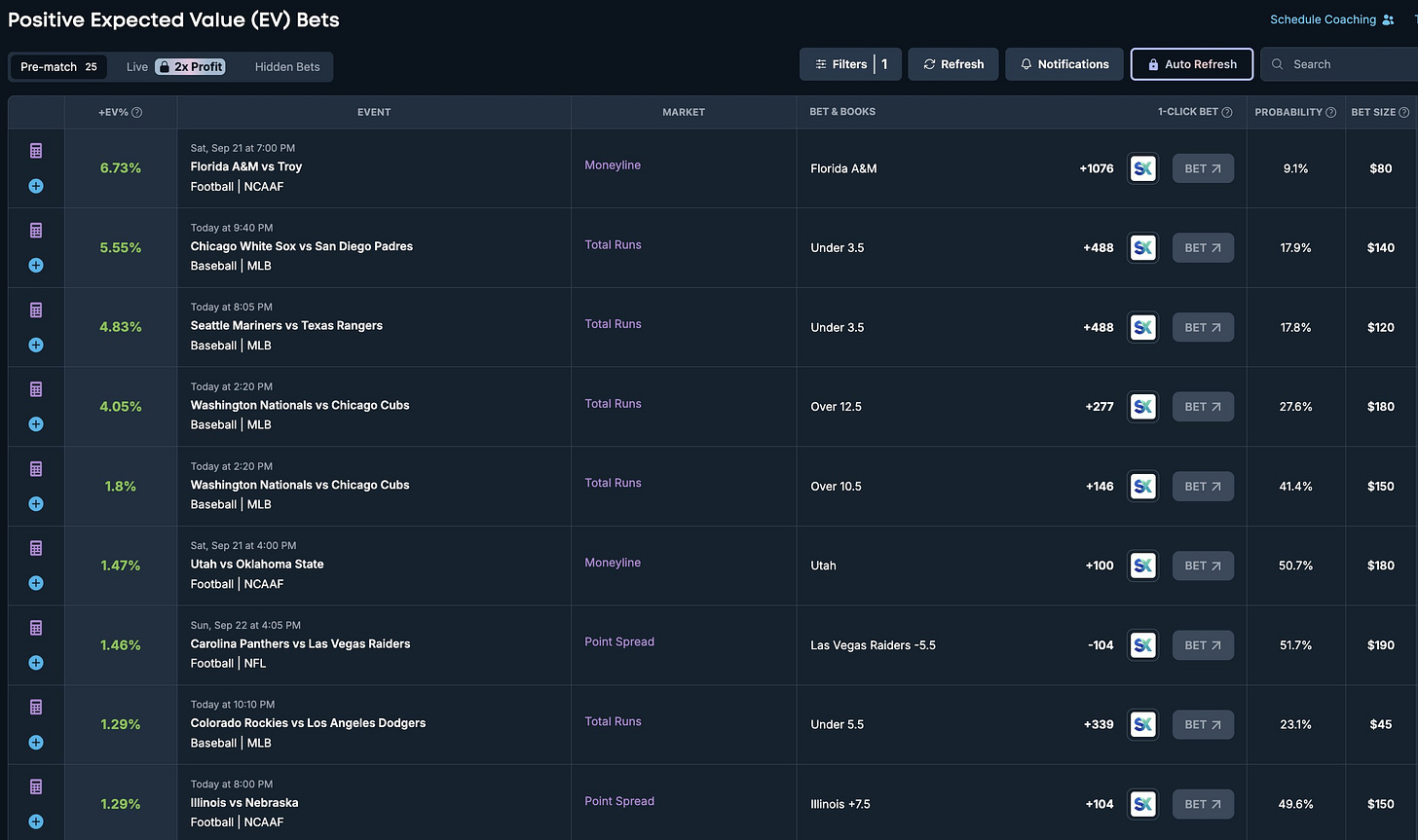

🫰 Hub for Positive EV Opportunities: Positive expected value (EV) bets are when the odds on a platform diverge with the rest of the global betting market, offering up potentially profitable arbitrage opportunities. Think of like it being able to buy Bitcoin for $58,500 on a platform when Bitcoin trades at $59,000 everywhere else. Because of SX’s superior and differentiated liquidity, there are many “positive EV” opportunities available on SX. There is a fast-growing community of Positive EV arbitrage bettors that hunt for these opportunities, often using odds comparison tools (such as OddsJam) to find them. As SX deepens its liquidity further, the opportunity set and attractiveness increases for these bettors. The picture below is a screenshot from OddsJam’s Positive EV bet scanner, showcasing EV opportunities on SX:

4) Challenges & Opportunities 🚧

🚨 Live Betting

SX has established as one of the best places in the world to bet pre-game North American sports (NFL, MLB, NBA, & NHL). However, our live betting offering is still quite mediocre. With limited coverage, low liquidity, and relatively average odds, SX’s live betting experience offers no tangible value prop beyond traditional betting platforms (while lagging razor-sharp exchanges like Betfair by a fair margin). This is partly by design; SX is focused right now on maximizing pre-game liquidity first, where it has a key competitive advantage.

It’s much better to be the best pregame betting platform in the world with mediocre live betting than having a solid but unremarkable offering in both. With that said, maximizing live betting will contribute massively to the overall value prop of the platform and overall activity (even with SX’s relatively weak offering, live betting constitutes roughly 40% of total volume on SX). We’ve begun researching a new order book design to minimize latency and improve execution times to make it easier for both market-makers and takers. With the new order book design will come a simpler API usage and integration process, which will better fit industry standards and make it easier for market-makers to integrate onto SX.

⚽ Soccer and Tennis Pre-game Liquidity

While SX’s tennis and soccer pre-game odds are solid compared to traditional sportsbooks, they are far weaker than SX’s major US sports offering. SX only occasionally offers the same major reduction in vig for soccer and Tennis that it consistently does for NFL, MLB, NBA, and NHL.

This partly reflects the increased difficulty in market-making these sports (schedules are less structured, particularly for tennis) and sheer increase in number of games available to bet. Even still, Tennis remains the second largest sport by pre-game volume (20% of total), reflecting SX’s international user base. Becoming the global liquidity hub for soccer and tennis pregame betting is a major opportunity for SX, and will be a primary focus in Q4 and beyond.

⛹️ Player Props & Exotic Markets

SX’s focus on driving down vig for sports bettors comes with some tradeoffs. One of the major tradeoffs is an increased difficulty in offering the same level of market coverage for recreational bettors. In effect, SX is following a Costco model for sports betting; much better pricing at the cost of limited coverage. With that said, unlike Costco, there are no direct incremental costs to adding more markets for bettors.

The cost is more subtle; exotic markets are harder to market-make (particularly in the highly adversarial environment of onchain betting) and therefore would have much worse pricing than SX’s major markets. This makes the platform inherently less attractive than more recreational-heavy platforms, hurting adoption. With that said, as SX continues to scale and add more market-makers, it does become more and more feasible. SX is getting close to that inflection point where there is enough market-maker interest to seed these markets. This will be an area of focus in late Q4 and 2025.

5) Catalysts 🚀

There are many short-term catalysts on the horizon that are going to unlock new growth for SX.

🏀 Return of NBA (& NHL)

While MLB season will be winding down in Q4, NBA and NHL seasons will both be beginning in October. NBA and NHL collectively represent 30% of total betting volume on SX. Furthermore, we expect SX to have the lowest vig in the world for both sports. With the recent integration on MollyBet being complete, we expect this to contribute significant betting volume to the platform.

📈 Cross-Chain Launches

With the recent success of SX Bet on Arbitrum, we’re also exploring public launches of SX Bet on other chains. We’ll be targeting established whale-heavy chains (such as Ethereum, Polygon, etc.) and new fast-growing chains (such as Scroll, etc.) There is a significant opportunity to establish SX as the de-facto onchain sports betting platform of many chains.

🎰 Onchain SX Casino

SX has the largest onchain sports betting community in the world, creating a huge opportunity for SX to monetize through the launch of a SX-branded onchain casino. Casino games are some of the most highly-requested features by the SX community. This would open up SX to more types of bettors, stabilize betting volumes in the low summer months, and increase value accrual for SX. Casino games typically generate a multiple of the total volume and revenue of sportsbooks. SX’s onchain casino will offer the highest RTPs (return to player) of any in the industry today.

6) Final Word

Let us know if this format of monthly reporting is beneficial and we’ll keep it up to help fill in the missing details. We appreciate the ongoing support and feedback from our community and backers. As always, we encourage you to stay engaged through our real-time dashboard and community channels. Together, we will continue to build a stronger and more innovative SX ecosystem.

(Any views expressed in the above are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions. SX Bet is not available in the United States or other prohibited jurisdictions.)