SX #74 - Q2 Review

SX's best Q2 ever in terms of betting volume, user growth, and roadmap items

1) Quick Summary 🗞️

Betting volume of $44.0m in Q2 vs. $30.3m in Q2 2023 (+45%)

Monthly active bettors grew +130% YoY in both May and June

Launched Arbitrum cross-chain betting & seeing steady cross-chain growth

Dev focus in Q3: launch of SX Rollup & exploring onchain casino games

Biz focus in Q3: cross-chain launches, major integrations, growth initiatives

2) Key Metrics 📊

Sports betting is seasonal, so it's best to compare quarters year-over-year (YoY) to truly suss out underlying trends. The following charts show SX’s metrics in Q2 (April-June) since our initial launch in 2019:

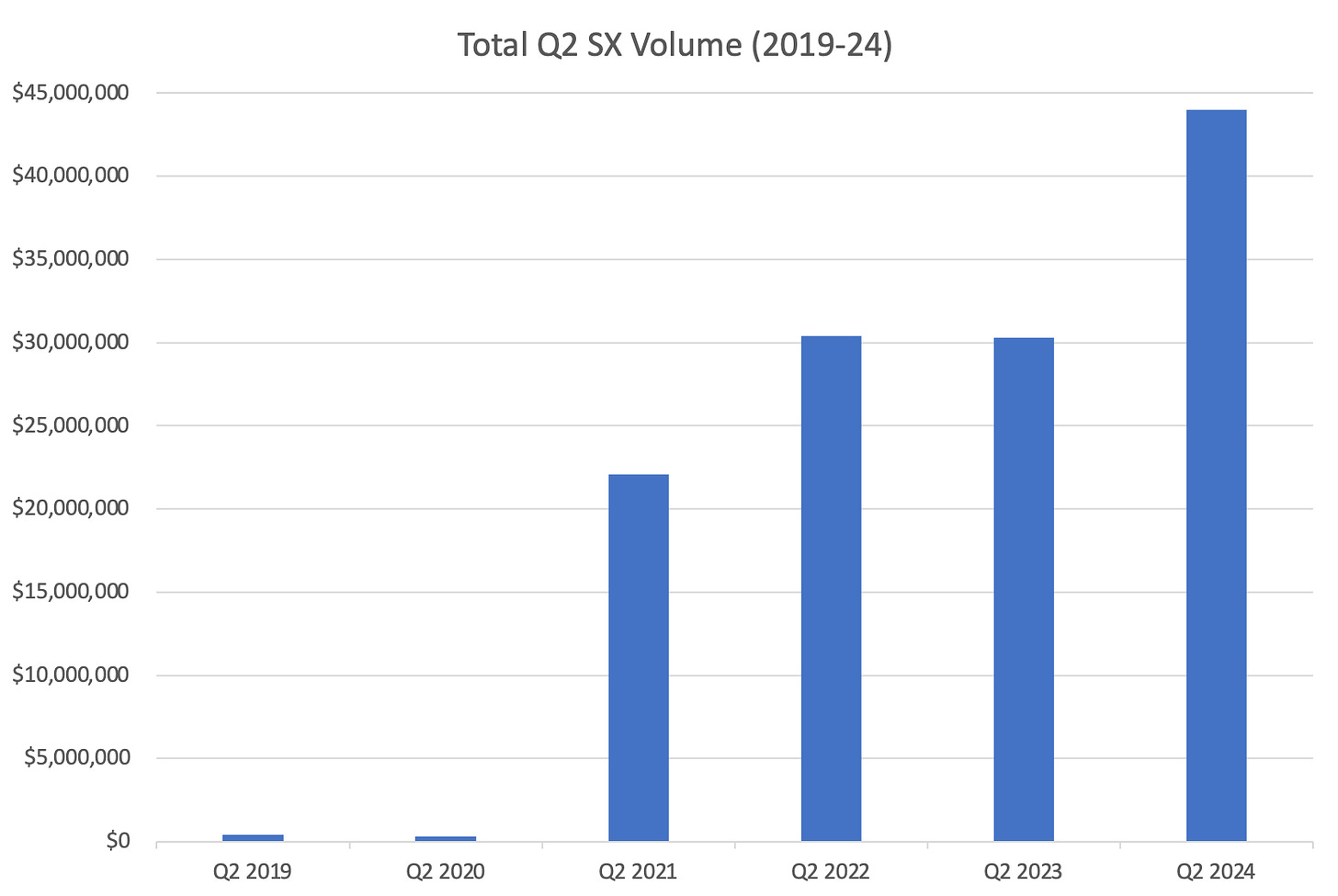

Betting Volume

The chart above shows SX's total betting volume in Q2, from 2019 to 2024. As we can see, betting volume in Q2 have grown since inception, peaking at $44m this quarter (representing a 45% increase YoY).

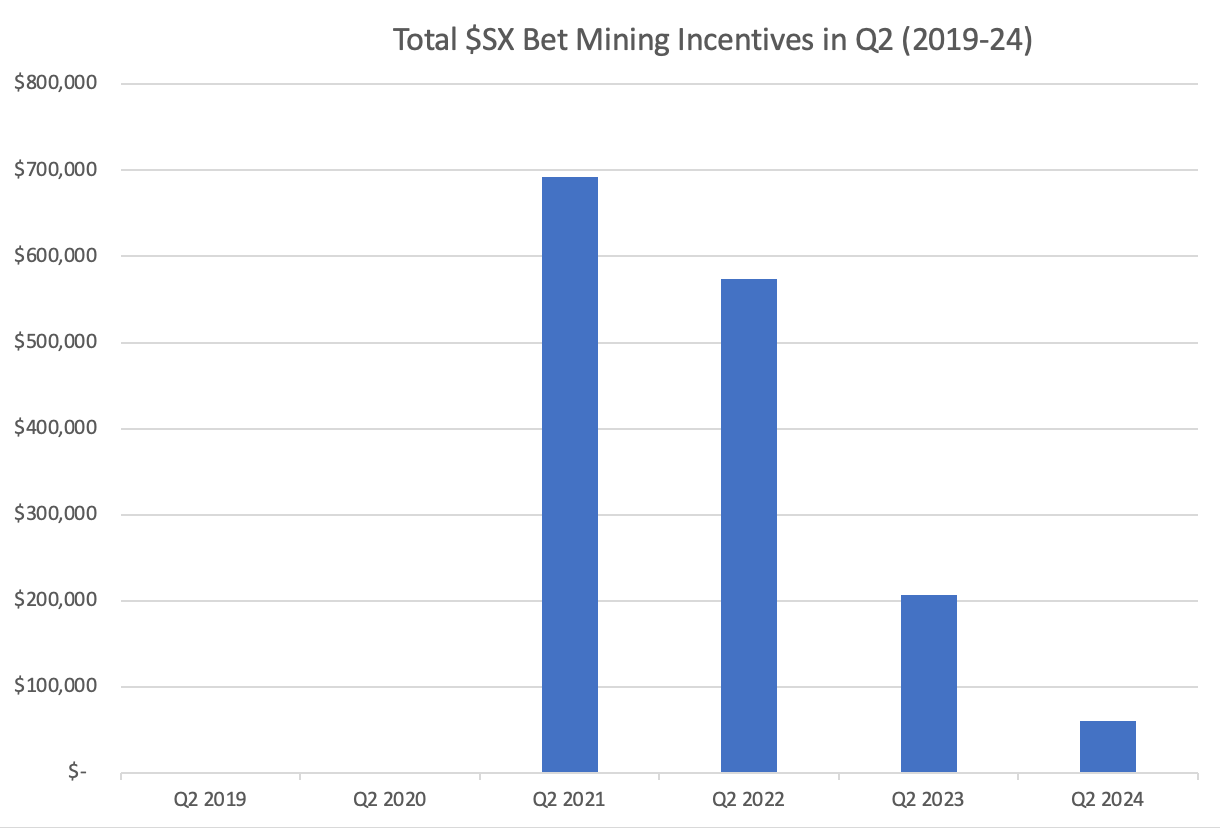

SX Bet Mining Incentives ($)

The upward trend in betting volume is contrasted by a consistently decreasing trend of SX bet mining incentives spent in Q2, shown in the chart above. Total bet mining incentives have decreased 91% in dollar terms from a high of almost $700k in Q2 2021 to just $60k in Q2 2024.

For context, SX token was launched in January 2021, hence why Q2 2019 and Q2 2020 show $0. Bet mining was recently turned off entirely, with little impact on volume, reflecting the strong product-market fit of the core exchange product.

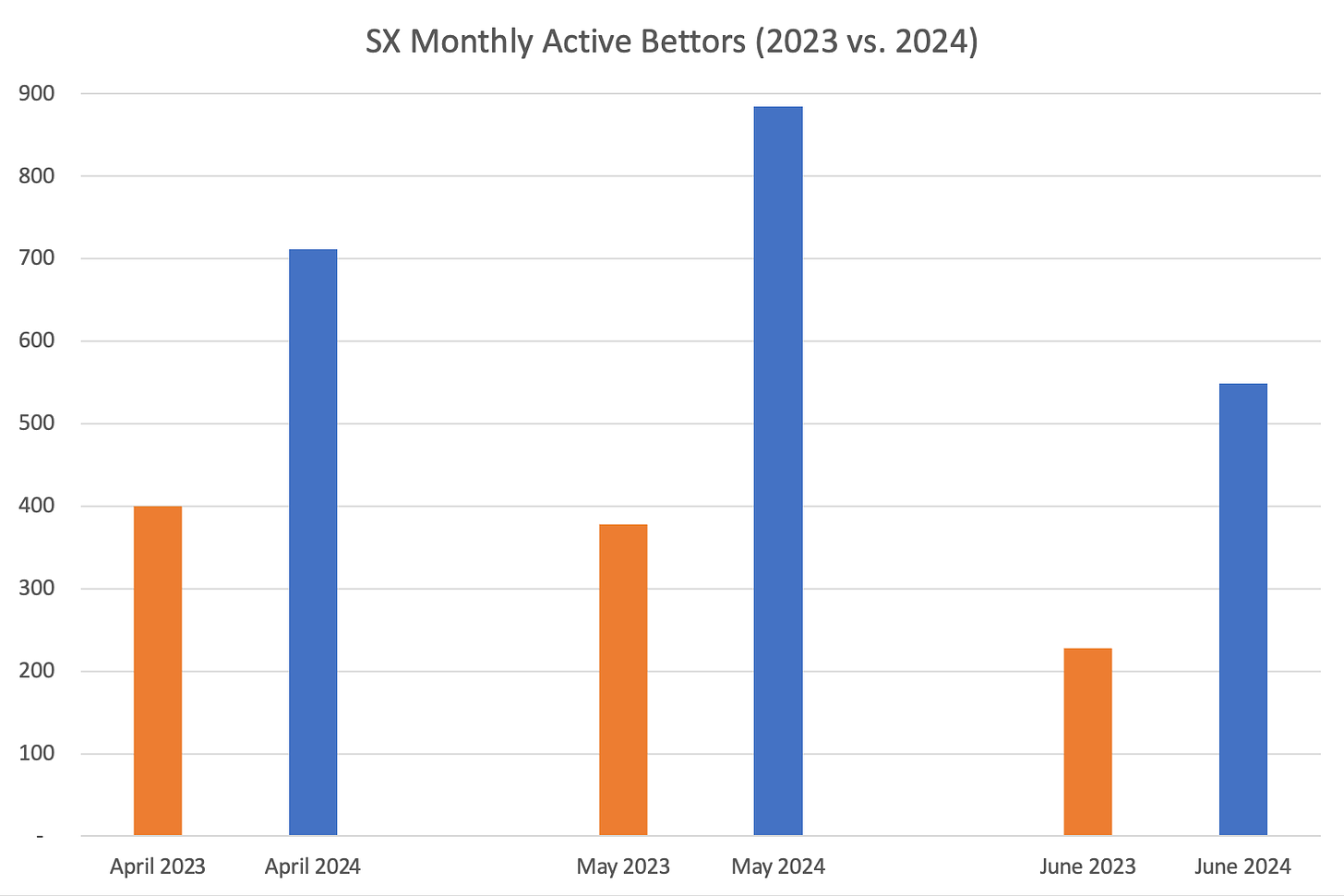

Monthly Active Bettors

Total monthly active bettor numbers were also up across the board, with YoY increases of 78%, 134%, and 141% in the months of April, May, and June, respectively.

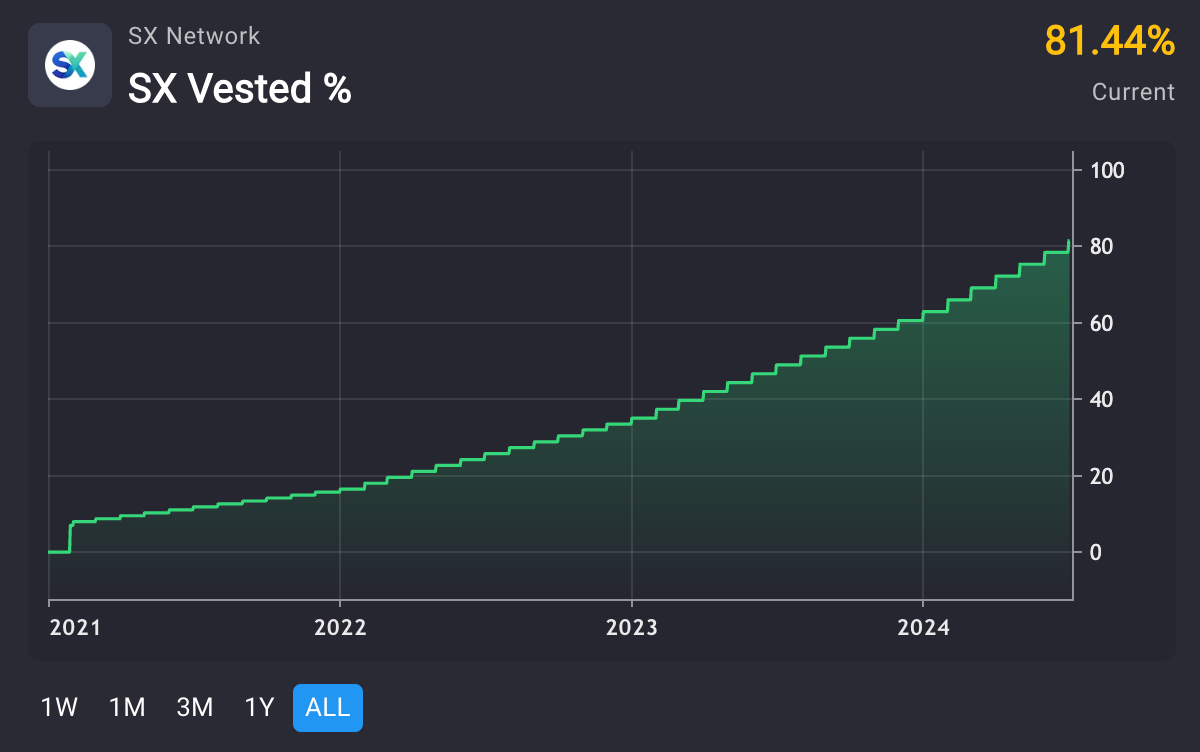

SX Token Vesting

Finally, SX token is now 81.44% vested. As a reminder, SX token launched in January 2021 with a 4-year monthly linear vesting contract for team members, backers, advisors, and the community fund. The final vesting month is on February 1st, 2025, which is now less than 7 months away. At that point, SX token will be 100% vested and no new supply will be unlocked.

3) Achievements ✅

Beyond the numbers, SX has had a busy quarter on both the technical and business side in Q2:

Technical

Launch of Arbitrum Betting: Users can now bet on any SX pre-game market from Arbitrum. This included the launch of a gasless bridge between SX Chain and Arbitrum, enabling users to bridge funds between them seamlessly. Cross-chain betting functionality is limited initially to pre-game betting, with full functional offering going live post-rollup migration.

Launch of Portfolio Page: New feature shows real-time “edge” of bets, which enables users to see exactly how much better the odds they receive on SX. Also includes PnL from past bets, better UX, and more.

Launch of Alternative Lines: SX also launched betting on alternative betting lines, a highly requested feature from the community. This drastically increases the number of spread and total betting markets, providing users with more options and programmatic bettors with more options to hedge exposure.

Growth

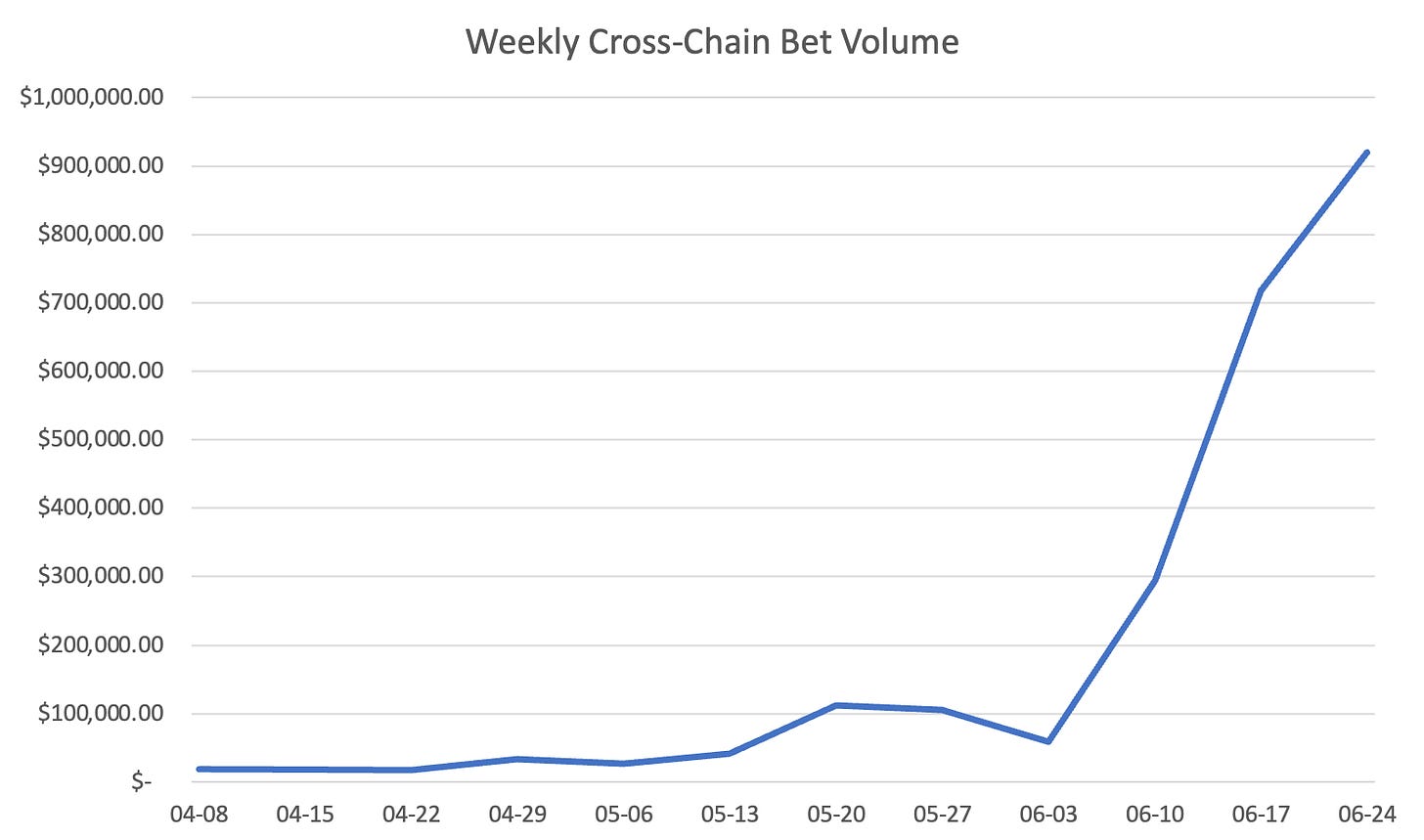

Cross-Chain Launch: Earlier this year, SX launched it’s first cross-chain deployment on Arbitrum L2. In conjunction with this launch, SX applied and received a 498,000 $ARB ($550k) grant to be spent on user growth and liquidity mining incentives over the summer. The first tranche of this grant is being spent on SX’s largest betting tournament ever - the $69,420 Arbitrum Summer Kickoff tournament that recently went live. Cross-chain betting volume continues to grow week-over-week, as shown below:

User Requested Markets: Launched new feature where users can create their own markets and earn 0.25% of the volume the market generates in bet credits. Have already created +50 new user-generated markets.

Partnership with InplayLIVE: InplayLIVE is one of the premier communities for sophisticated sports bettors. SX recently hosted a private betting tournament for their community in addition to being hosted on their podcast to discuss SX. Here’s the founder of Inplay describing SX to his community: https://x.com/_inplayLIVE/status/1789353551011164194

4) Challenges 🚧

Outdated Infrastructure

SX Network is the first and only sports betting-focused blockchain that is operational today, built on Polygon Edge. However, it’s become clear over the last few months that the SX Network blockchain needs to move off of its original Polygon Edge infrastructure. The Polygon team recently sunsetted their support for the Edge SDK, creating additional difficulties.

SX Network block times are currently 2 seconds, which is far too slow to do cross-chain live betting. In order to make cross-chain experience comparable to the SX-native experience, it’s critical that live betting is possible.

Onboarding Friction for Professional Bettors

SX currently routinely has the best odds in the world for NBA, MLB, and NFL pre-game markets, beating more established exchanges like Betfair and sportsbooks like Pinnacle. However, many professional bettors are scared off by the added complexity and friction of a non-custodial web3 platform like SX.

While SX has onboarded many market-makers and API bettors, there are still a number of professional bettors and syndicates that have looked into SX but chose not to on-board due to the friction.

Weak Tokenomics

SX recently cut commission rates to 0%, which has enabled SX to achieve its vision of offering the best pre-game odds in the world for NBA, NHL, and MLB. However, this means SX is entirely dependent on an inflationary model to reward stakers.

While this inflationary model is the current industry standard in crypto, it still needs to be addressed for the platform to be sustainable long-term.

5) Catalysts 🚀

Keeping these challenges in mind - many of the short-term catalysts on the horizon deal with solving these key obstacles, thereby unlocking new growth for SX.

SX Rollup

SX will be migrating off Polygon Edge onto it's own Arbitrum Orbit rollup in the summer. This offers a number of huge advantages for SX: 8x faster block times, much better/secure bridging, and simplification of staking. Finally, the faster block times enable SX to launch new features such as trustless on-chain order books, cross-chain live betting, and on-chain casino games.

The SX Rollup will be launching with a gasless bridge to enable seamless bridging between the old SX Network chain and the new SX Rollup; users should expect the entire migration to take less than 5 minutes. This is currently the number one priority of the SX core dev team, expect a number of updates on this over the coming weeks.

Aggregator Integration

SX is currently working on getting integrated into one of the world’s largest aggregator of sports betting liquidity in the entire world. Professional bettors use these aggregators as a one-stop shop for tapping into all the world’s top betting markets in one, easy-to-use interface.

Most importantly, professional bettors get to access this liquidity directly through the aggregator. This integration could potentially drive huge amounts of taker flow to SX’s exchange. SX’s industry-leading odds put it first-in line to access betting aggregator taker flow, helping drive a virtuous cycle of activity and liquidity to SX. This integration is still in development, but things are currently on-track for a Fall release.

SX Tokenomics 3.0

There are three potential routes for introducing protocol revenue to SX Network without weakening the core value prop of the platform. Each revenue stream will generate USDC-based revenue, which will be used to automatically buyback SX onchain and be distributed to SX stakers. These will enable SX to shift away from inflationary staking rewards, and distribute protocol revenue directly to SX stakers.

Cross-Chain Fee: SX is planning on deploying unique interfaces on a number of exciting L1 and L2 blockchains in the coming months utilizing its cross-chain betting functionality. Cross-chain bettors are expected to be relatively price-insensitive users that value convenience and promotions over liquidity. Cross-chain betting volume is Taker-only and currently constitutes ~20% of current daily betting volume. At SX’s current betting volumes of $15m/month, a 2% fee on cross-chain bet winnings would translate to ~$30,000/month in protocol revenue.

Tiered Taker Fee: SX can also re-launch traditional commissions on SX betting volume to generate revenue. One potential route would be to do tiered commission structure while focusing purely on Taker bets. Based on current volume proportions, charging pre-game taker bets 1% of winnings, in-play taker bets 3% of winnings, and parlay taker bets 5% of winnings, would create a blended overall take rate of ~0.5% on all betting volume. At SX’s current betting volumes, this could be expected to roughly generate ~$75,000/month in protocol revenue.

Onchain SX Casino: SX has the largest onchain sports betting community in the world, creating an opportunity for SX to monetize through the launch of an SX-branded onchain casino. Casino games would open up SX to more types of bettors, stabilize betting volumes in the low summer months, and increase value accrual for SX. It’s extremely difficult to project protocol revenue from casino games as it requires projecting total betting volume from an entirely different product suite. Casino games typically generate a multiple of the total volume and revenue of sportsbooks.

It’s also important to note that SX Governance recently passed a proposal to burn 110m SX from the SX Community Fund. This proposal will be enacted once the migration to SX Rollup is complete, dropping the total issuable supply of SX from 1,000,000,000 to 888,888,888. This will also coincide with dropping the SX staking cooldown from 30 days to 14 days.

6) Final Word

Onchain betting adoption remains a fraction what it will likely be in the years ahead. As a reminder - total onchain betting revenue is <$10m/year, whereas centralized crypto-based betting revenue is ~$3b/year, and total online betting revenue is estimated to be ~$100b. If you were to compare relative onchain betting adoption to onchain token trading adoption, we’d be somewhere in early 2019 when Uniswap first hit $10m in TVL. It’s extremely early still.

The exponential growth inflection for onchain betting feels very close. As the largest onchain sports betting project in the world by betting volume, SX aims to drive this inflection through superior odds, transparency, and security.

We appreciate the ongoing support and feedback from our community and backers. As always, we encourage you to stay engaged through our real-time dashboard, weekly newsletter, and community channels. Together, we will continue to build a stronger and more innovative SX ecosystem.

(Disclaimer: Any views expressed in the above are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions. SX Bet is not available in the United States or other prohibited jurisdictions.)